Category Pension News

The High Court of Panjab and Haryana has dismissed 808 writ petitions challenging the 15-year period for pension restoration after commutation. The petitions, filed by retired Punjab government employees, had sought restoration of commuted pension after a shorter period of about 12 years, arguing that the existing 15-year period was arbitrary and unjustified.The amount of…

Pension Restoration: High Court Upholds 15-Year Commutation Period was originally published on All India RBI Oers Pensioners Forum

The Department of Posts, via India Post Payments Bank (IPPB), has introduced a new doorstep service to help pensioners submit their Digital Life Certificates (DLC). This service aims to make the process easy and convenient. We encourage you to take… Continue Reading →

The concept of granting additional pensions to Central Government Pensioners, as being circulated in the media reports, is not new, and numerous eligible pensioners are already benefiting from this provision.

The bank has recently modified the Medical Assistance Fund (MAF) Scheme for retirees. These changes are aimed at providing better support and clarity for the dependents of MAF members, particularly those with permanent disabilities. Here are the key points from… Continue Reading →

Reports indicate that the Reserve Bank has begun distributing the 90th Year Silver Memento to current staff and those who retired after April 1, 2024. Individuals joining the Bank by March 31, 2025, are also eligible for this memento. However,… Continue Reading →

The RBI has noted the rise of unauthorized websites and applications that falsely claim to be registered with the Bank. These entities pretend to offer legitimate financial services or digital lending applications. Public trusts them unwittingly.

Government employees switching to the Unified Pension Scheme (UPS) can hope to see a significant increase in their pension, as the government’s contribution is set to increase from 14% to 18.5%.

Following our update on the Unified Pension Scheme, we present a comparison chart below detailing the differences between the Old Pension Scheme (OPS), National Pension System (NPS), and Unified Pension Scheme (UPS).: Feature Old Pension Scheme (OPS) National Pension System… Continue Reading →

Understanding the Unified Pension Scheme: A New Era for Government Employees The Unified Pension Scheme (UPS), recently approved by the Union Cabinet, marks a significant shift in the pension landscape for central government employees. Set to launch on April 1,… Continue Reading →

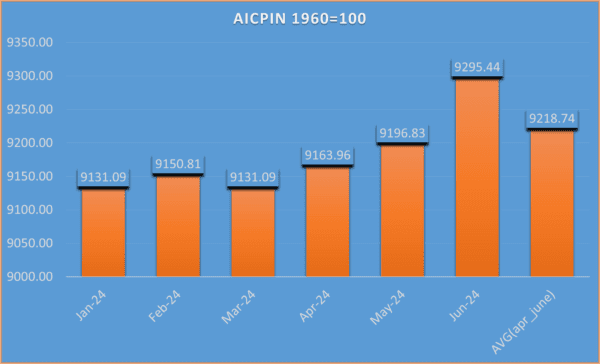

Data indicates an increase of 23 slabs for RBI Pensioners, Family Pensioners, and other Bank Pensioners whose pension is merged at 6352 points.

The increase is 1.61% over the earlier half year and the total DR comes to 50.12% of the Basic Pension. The details are given in the chart below.