All India Reserve Bank Retired Employees Association(AIRBREA), Mumbai have called for urgent settlement of long pending pension grievances. The letter, dated May 2, 2025, requests Bank to examine the issues and take suitable remedial steps to do justice to the retirees.

Below is a detailed overview of the unresolved issues and the retirees’ demands for equitable treatment:

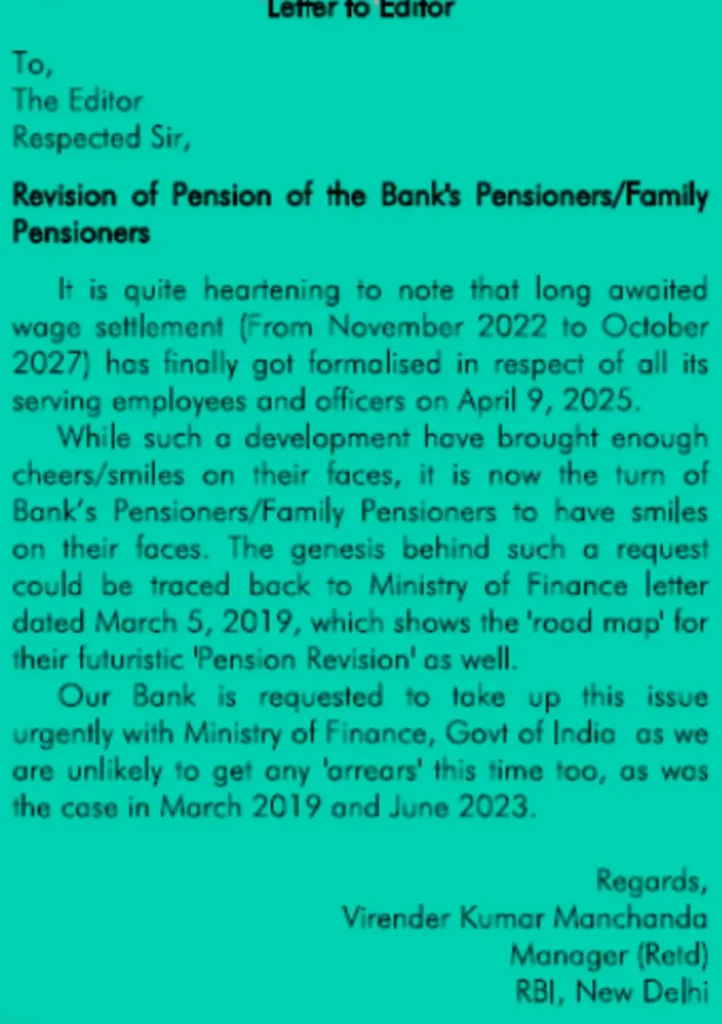

Pension Revision

AIRBREA stresses the urgent need to revise pensions retrospectively from November 2002, as done in case of wage revisions for serving employees. Ministry of Finance has imposed conditions on pension revisions, leading to unfair treatment of retirees. Previous legal opinions from experts supported pensioners, but despite this, the Ministry has repeatedly blocked fair revisions.

Pension revisions should take effect from the date of salary revisions in RBI rather than from the date of government approval, ensuring retirees receive arrears for past periods.

Family Pension Revisions:

AIRBREA points out that family pensioners have suffered from outdated calculations. Previously, family pensions were revised based on old salary scales (from 2007), meaning many family pensioners received much lower payments than they should have under more recent wage settlements (2012 and 2017).

After multiple appeals, RBI updated the family pension calculations in December 2023, applying them retrospectively from March 2019. However, since the family pension is directly linked to pension revisions, the family pension should also be updated further in line with the broader pension revision appeal (para2 above).

Enhanced Support for Elderly Pensioners

Pension Enhancements for those 80 years and above:

Citing the Sixth Central Pay Commission (2006), AIRBEA has sought additional pensions for those aged 80+ to address rising healthcare and living costs. Central government employees have received such benefits since 2006, but RBI pensioners await similar relief despite two decades of appeals.

Double Family Pension extension:

Double Family Pension for 10 Years

The double family pension (for families of deceased employees) is currently granted for 7 years in RBI, while in government service, it is granted for 10 years. This should also be aligned with the existing Central Government policy.

Inclusion of Dependents

Current RBI Pension Regulations exclude widowed/divorced daughters from family pensions after age 25, leaving many without financial security. AIRBEA has requested the bank to suitably direct amendments in regulations and make such widowed /divorced daughters eligible to receive Family Pension, even beyond 25 years of age mirroring GOI’s policies.

Ex-Gratia & Medical Aid:

Pre-1986 retirees and families of deceased employees receive meager ex-gratia payments, unchanged for over 30 years. With beneficiaries now aged 100+, the plea calls for enhanced financial aid and medical support to reflect inflation and soaring healthcare costs. AIRBREA stress that the RBI’s legacy must include compassion for its earliest contributors.

Pension Calculation Anomalies:

Post-2017 pension reforms created disparities between pre- and post-October 2017 retirees. While newer retirees benefit from calculations based on last-drawn salaries, earlier retirees face reduced pensions due to outdated formulas. Retirees demand notional re-fixation for all, ensuring uniform application of fair policies under Pension Regulation 28.

Gazette Notification Delays: Prioritizing Timely Relief

Delays in publishing Gazette notifications for pension reforms deprive retirees of timely benefits. Historically, the RBI implemented changes first and formalized them later, but recent reversals have caused financial losses. Retirees urge a return to the time-tested practice of granting relief immediately, with Gazette updates following.

Urgent MoF Approval: Minimizing Financial Losses

With fresh wage revisions finalized in April 2025, AIRBEA implores the RBI to expedite MoF approvals for pension updates. Delays compound financial strain, particularly for elderly pensioners on fixed incomes. Bank should undertake swift action and prioritize swift resolution.

Conclusion: A Plea for Compassion and Legacy

By settling these grievances, the RBI can reaffirm its commitment to justice, constitutional values, and the dignity of its retirees.

Leave a Reply

You must be logged in to post a comment.