Category banking general

The Reserve Bank of India (RBI) is set to payout a significant dividend payout to the central government, driven by its interventions in the currency markets to stabilize the rupee. Experts predict a transfer ranging from ₹1.5 lakh crore to… Continue Reading →

Dear Friends,We extend our warmest greetings and best wishes to all our fellow retirees, especially those from the Reserve Bank of India and other esteemed banking institutions. We also extend our greetings to the RBI Governor and management for effectively… Continue Reading →

It is with profound sadness that we, as RBI retirees, express our heartfelt condolences on the passing of Dr. Manmohan Singh. His demise marks the end of an era of unparalleled economic wisdom and leadership. Dr. Singh’s illustrious career spanned… Continue Reading →

The Department of Posts, via India Post Payments Bank (IPPB), has introduced a new doorstep service to help pensioners submit their Digital Life Certificates (DLC). This service aims to make the process easy and convenient. We encourage you to take… Continue Reading →

The RBI has noted the rise of unauthorized websites and applications that falsely claim to be registered with the Bank. These entities pretend to offer legitimate financial services or digital lending applications. Public trusts them unwittingly.

Government employees switching to the Unified Pension Scheme (UPS) can hope to see a significant increase in their pension, as the government’s contribution is set to increase from 14% to 18.5%.

Following our update on the Unified Pension Scheme, we present a comparison chart below detailing the differences between the Old Pension Scheme (OPS), National Pension System (NPS), and Unified Pension Scheme (UPS).: Feature Old Pension Scheme (OPS) National Pension System… Continue Reading →

Understanding the Unified Pension Scheme: A New Era for Government Employees The Unified Pension Scheme (UPS), recently approved by the Union Cabinet, marks a significant shift in the pension landscape for central government employees. Set to launch on April 1,… Continue Reading →

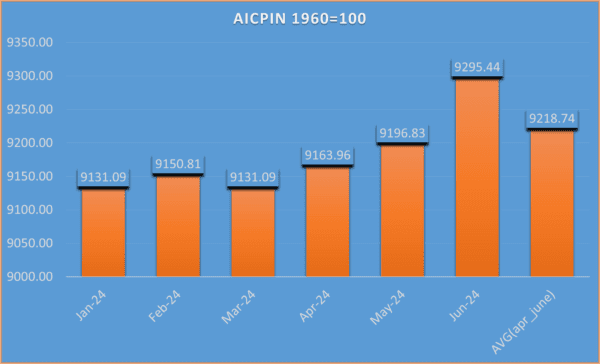

Data indicates an increase of 23 slabs for RBI Pensioners, Family Pensioners, and other Bank Pensioners whose pension is merged at 6352 points.

The increase is 1.61% over the earlier half year and the total DR comes to 50.12% of the Basic Pension. The details are given in the chart below.

Notably, the RBI transferred a surplus of Rs 9,75,118 crores to the Government of India between 2011/12 and 2023/24, a remarkable achievement.